.avif)

.avif)

The Opportunity: Education as a Strategic Asset

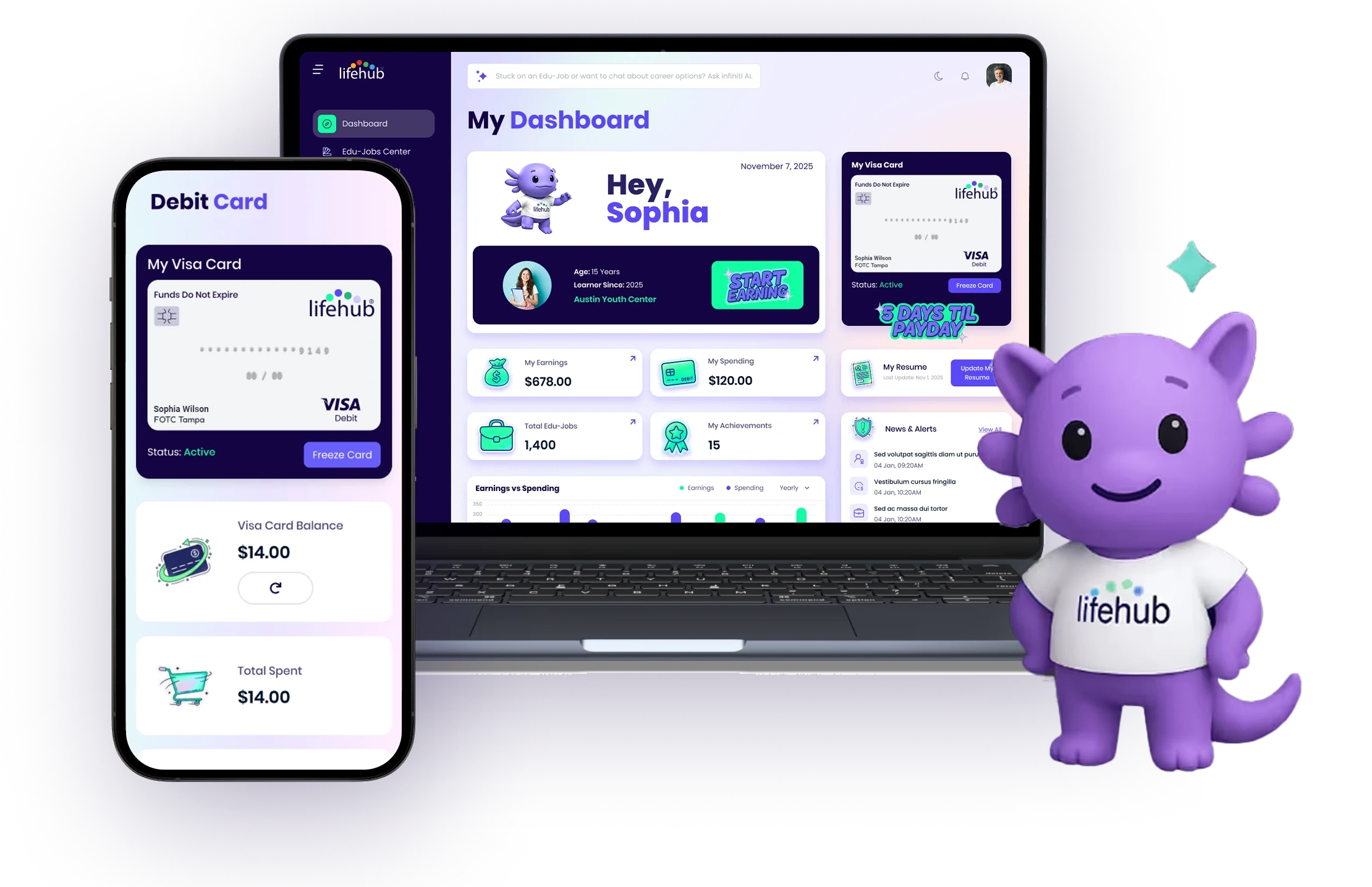

The financial world is evolving rapidly. For many young people, sectors like stock brokerage, mortgage lending, credit reporting, and fintech feel like black boxes.

As a leader in financial services, you have a unique opportunity to change that narrative. You aren't just a platform or a lender; you are an educator.

We invite you to partner with us to deliver "Happy Life Skills". We move beyond generic advice to provide deep, industry-specific learning that prepares youth for real financial interaction—investing in the market, buying a home, and navigating the digital economy.

The Partnership Model:

Your Brand, Their Classroom

We don't just want your logo; we want your knowledge. Our partnership model is designed to let you co-create the curriculum, ensuring that users learn about your specific industry through the lens of your brand.

Here is how we translate your business into educational value:

Industry-Specific "Edu-Jobs"

We work with your team to create interactive learning modules called Edu-Jobs that explain the "What," "How," and "Why" of your sector.

For Stock Brokerage Firms

Sponsor the "Market Mover" track. Teach students how the stock market actually works, the mechanics of a trade, the difference between a stock and an ETF, and the importance of long-term perspective. Democratize access to financial knowledge before they place their first trade.

For Mortgage Lenders

Sponsor the "Path to Homeownership" module. Break down interest rates, down payments, equity, and the difference between good debt and bad debt.

For Fintech & Payment Processors

Sponsor the "Future of Money" series. Demystify digital wallets, peer-to-peer payments, transaction security, and the technology that moves money around the world.

For Credit Agencies

Sponsor the "Credit Master" track. Teach students how scores are calculated, why they matter for future opportunities, and how to build a history of trust.

Leadership & Career Spotlights

Humanize your corporation by featuring your actual leadership team

Meet the Experts

We produce exclusive "Day in the Life" content and interviews with your team.

Career Pathways

Show students that financial services offers diverse, high-tech career paths. Whether it's a Market Analyst, a Fintech Developer, a Loan Officer, or a Data Scientist, we help you showcase the opportunities within your organization.

.avif)

.avif)

Branded Micro-Credentials

When a student masters your content, they earn a digital badge co-branded with your firm.

Example

A student completes the "Trading 101" module and earns the "[Your Firm Name] Junior Analyst Badge."

Verified Success

This badge lives in their permanent digital portfolio, serving as lasting social proof of your brand's commitment to their success.

Why Partner?

Strategic Business ROI

This is more than philanthropy; it is strategic market positioning.

ESG & Social Impact That Measures Up

This is more than philanthropy; it is strategic market positioning.

Data-Driven Impact

Our Infiniti AI™ engine tracks every module completed and every dollar earned by students. We provide you with granular reports on how your partnership improved financial literacy rates in specific demographics or geographic regions.

Direct Community Uplift

Your partnership funds the "Youth Earnings Fund." Students earn real money for learning your content, meaning your ESG budget goes directly into the hands of the families you serve.

.avif)

.avif)

Workforce Pipeline Development

The financial services sector faces a massive demand for tech-savvy talent.

Early Recruitment

By sponsoring career-readiness tracks, you are introducing high-potential students to your industry years before competitors do.

Skill Building

We teach the soft skills (communication, critical thinking) and hard skills (Data Analysis, Digital Literacy) that your future employees need.

Long-Term Customer Loyalty

Trust is built through education.

Empower Earners

By helping a young person understand how to read a stock chart or how a mortgage works today, you position your brand as the trusted platform they will use tomorrow. You are building a relationship with the "Earner Generation".

.avif)

Our Capabilities

We are built for scale, security, and engagement.

.avif)

Targeted Reach

Whether you need to reach underserved communities or specific school districts, our platform scales to meet your geographic focus.

.avif)

Brand Safety

A fully moderated, compliant, and secure environment for your brand to interact with youth.

.avif)

Turnkey Content Creation

Our team handles the heavy lifting of gamification and instructional design—you provide the subject matter expertise, and we make it fun.

.avif)

Let’s Write the Future of Finance Together

Your industry drives the economy. Let’s teach the next generation how to navigate it with confidence.

Empower the next generation of investors, homeowners, and financially savvy citizens.

Ready to Chat about Life Hub?

Whether you're an educator, administrator or school executive director — we can talk to craft a plan for you.

.svg)

.svg)